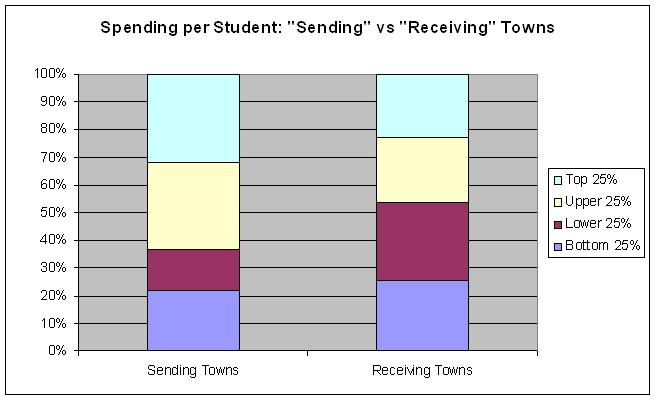

Are "receiving" towns driving up costs?

Under Acts 60 and 68, there are so-called "sending" towns and

"recieving" towns. "Sending" towns are those that raise more

in

education taxes than they spend on education locally. As a

result, they "send" the additional education tax dollars for use by

"receiving" towns. "Receiving" towns are those that raise

less in

education taxes than they spend locally and as a result "receive" the

funds needed to cover the remaining expense. Essentially,

these

funds come from the "sending" towns. It is sometimes

suggested

that because "receiving" towns can approve budgets for amounts beyond

what will be raised locally in tax dollars and have the difference

covered by "sending" towns, they will be more likely to increase

education spending. Analysis of actual data suggests that this is not

in fact happening.

For this analysis, the towns were divided into two groups.

"Sending towns" were defined as those whose 2005 education

taxes

raised exceeded their 2005 education spending budget.

"Receiving

towns" were defined as those whose 2005 education taxes raised were

less than their 2005 education spending budget. For the entire

list of towns, each town was "bucketed" based on how their

spending per pupil compared to all other towns. The buckets

were:

- Top 25% -- towns in this bucket were in the top 25% of

towns in spending per pupil (i.e. had the highest spending per pupil)

- Upper 25% -- towns in this bucket were above the bottom 50%

and

below the top 25% in spending per pupil (i.e. high but not the highest)

- Lower 25% -- towns in this bucket were below the top 50%

and

above the bottom 25% in spending per pupil (i.e. low but not the lowest)

- Bottom 25% -- towns in this bucket were in the bottom 25%

of

towns in spending per pupil (i.e. had the lowest spending per

pupil)

As the graph below illustrates, "sending" towns are more likely to be

in the "Top 25%" and "Upper 25%" of spending per pupil than "receiving"

towns.

Here's the same information presented in tabular form:

| Spending per Student |

Sending

Towns |

Receiving

Towns |

| Bottom

25% |

13 |

50 |

| Lower

25% |

9 |

55 |

| Upper

25% |

19 |

45 |

| Top 25% |

19 |

45 |

Copyright (C) 2006 by Ken Dufort